Strategy Consulting Services within M&A Assignments – Increasing Quality of Due Diligence Results and Improved Planning

Today acquisitions are central elements of strategy implementation. But they are challenging entrepreneurial situations for both, buy and sell side. And they include significant risk potential. Thus M&A projects require an integrated, entrepreneurial approach which ensures continued and effective leadership from preparation via transaction to the post merger integration phase. M&A methodology and transformation management practices by dewey & partner help customers to successfully conduct their M&A projects. Work results of each phase are structured with implementation focus for further proceedings so as to quickly ensure readiness in stepping ahead.

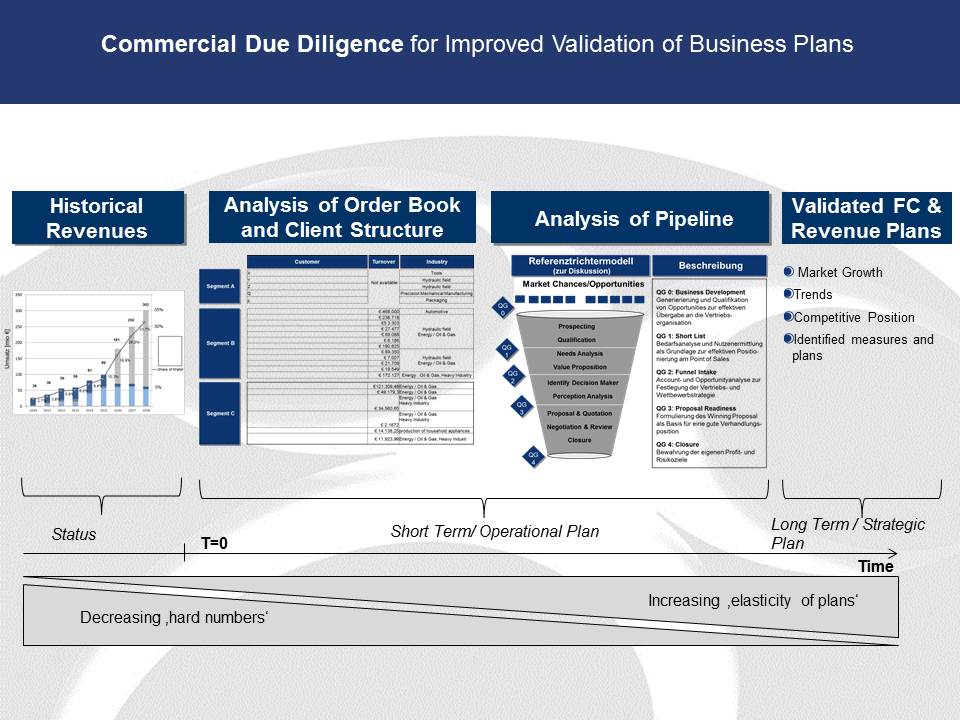

Well established proceedings within a Commercial Due Diligence are also an effective complement to conventional work of auditors (Finance, Tax) and lawyers (Legal). They can reuse business insights from the Commercial Due Diligence as well as the acquirer gains higher quality in due diligence results, performance transparency and opportunities for value levers. Market and technology analysis do validate the business plans of the sell side on revenue and EBIT level. Furthermore auditors do get for example hints for revaluation needs of assets and working capital or lawyers gain lists of critical questions for contract reviews. Identified risks and opportunities build up sceanrios which help in informed decision making if competitive bidding requires some price flexibility. And these insights should directly be used for action plans in case of later integration to ensure value creation.